February 01, 2020

6 Scams to Avoid That Target Small Business Owners

Taking precautions can help lower the risk of getting scammed. Unfortunately, it won’t eliminate the risk completely. When you recognize how scams work, you’ll be in a better position to stop them from occurring.

Scammers Are Terrible

To say that scammers are terrible is an understatement. They have little regard for people and will stop at nothing to drain your bank account. Many of them are proud to do so and will brag to their fellow scam artists. The problem is it’s difficult for governments to catch these scammers. There's a growing belief that the Chinese and Russian governments turn a blind eye towards scamming and hacking. In fact, one area in China has been dubbed “Scam Town” as a haven for scammers. However, the motivation of scammers is quite different. Some do it for obvious reasons, like financial gain. These scammers cause significant damage as they try to obtain access to accounts or will hold computers hostage. Another motivation of scammers is to act as an intermediary. They’ll steal access to many accounts and sell them to other scammers. These scammers will try to gain access to the accounts or use them for identity theft purposes.Six Common Scams Targeting Business Owners

The number of scams continues to grow worldwide, and the scammers performing these acts are getting more creative, too. Often, scammers follow common themes. Recognizing these themes can help you identify future business scams. Further, there are plenty of scammers who will attempt the same scams others have tried. Most likely, your business will experience one of these six common scams, so it's crucial to know how to combat them.1. Unordered Office Supplies/Products

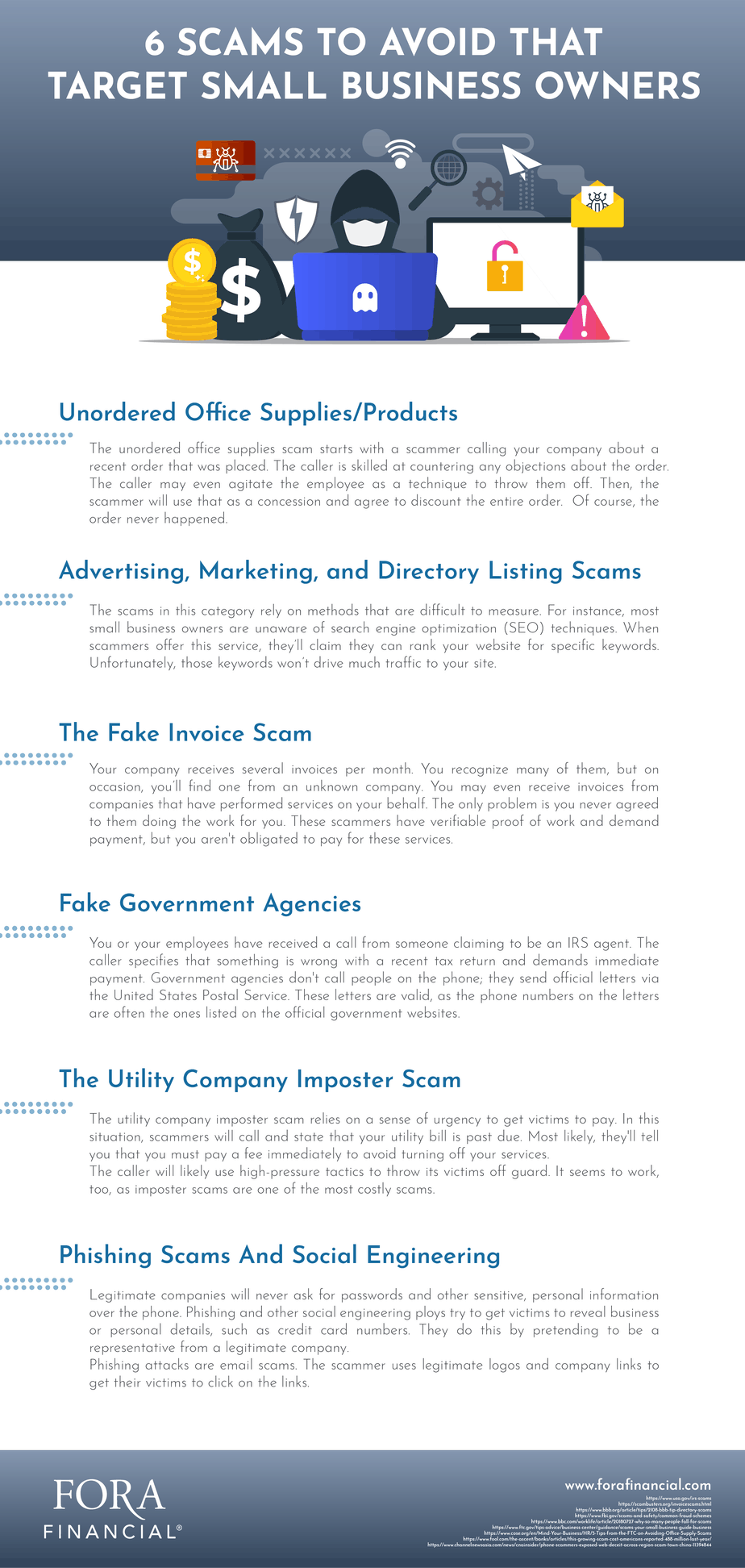

The unordered office supplies scam starts with a scammer calling your company about a recent order that was placed. The caller is skilled at countering any objections about the order. The caller may even agitate the employee as a technique to throw them off. Then, the scammer will use that as a concession and agree to discount the entire order. Of course, the order never happened. This scam is likely to work for companies that have several employees. Smaller companies, with only a few employees, will likely know whether anyone placed an order. It’s easier for employees of smaller companies to ask each other if any orders have been placed. To reduce the possibility of this type of scam, designate one of your employees to be the office purchasing manager. This person must approve all purchases and be the first line of contact for all office supplies. Create an approved vendor list. Work with the vendors on the list to appoint one contact person from the company. If someone calls your business claiming to be an approved vendor, tell them you’ll call back from a verified phone number. This procedure should be done when someone claims an order has been placed.2. Advertising, Marketing, and Directory Listing Scams

The scams in this category rely on methods that are difficult to measure. For instance, most small business owners are unaware of search engine optimization (SEO) techniques. When scammers offer this service, they’ll claim they can rank your website for specific keywords. Unfortunately, those keywords won’t drive much traffic to your site. Not all tactics in this category are scams, however. Some marketers are simply bad at what they do. They aren’t trying to scam anyone, but won’t produce the desired results. There are legitimate SEO companies that can produce superior results, which makes detecting scams more difficult. Solid companies will produce verifiable results. Another common scam is fake directory listings. Representatives from a directory listing company offer to list your business in their directory. The list may exist but won’t do anything to help your business. Remember, there are legitimate listing companies, so research carefully before paying for a listing. An offshoot of the directory listing scam is the domain listing or renewal scam. This scam is disguised as a domain registration renewal. The fine print will explain that you’ll be paying for a directory listing or other marketing service that won't benefit your company.3. The Fake Invoice Scam

Most likely, your company receives several invoices per month. You recognize many of them, but on occasion, you’ll find one from an unknown company. Usually, these invoices will be for services that are difficult to track, such as memberships. Some invoices come with inflated costs. Perhaps you remember work performed by a vendor, but the amount they charged is much more than the quoted amount. This happens with emergency work such as plumbing and locksmith services. They take advantage of the urgency of the situation. You may even receive invoices from companies that have performed services on your behalf. The only problem is you never agreed to them doing the work for you. These scammers have verifiable proof of work and demand payment, but you aren't obligated to pay for these services. The FTC advises consumers to never pay invoices that they don’t recognize. Having a single point of contact for all bills can reduce the risk of getting scammed. Larger companies may have an accounts receivable department to handle all invoices. This department would be responsible for following up on invoices. Small businesses can take precautions by training employees to question invoices. One method to keep everyone informed is to set up a Google Sheet with received invoices. All employees can view the invoices in real-time.4. Fake Government Agencies

Most likely, you or your employees have received a call from someone claiming to be an IRS agent. The caller specifies that something is wrong with a recent tax return and demands immediate payment. The IRS isn't the only government agency that gets used as part of a scam. Homeland Security, the FBI, and the Federal Trade Commission are just a few of the agencies that scammers pretend to represent. Government agencies don't call people on the phone; they send official letters via the United States Postal Service. These letters are valid, as the phone numbers on the letters are often the ones listed on the official government websites. Some scammers use traditional mail to execute their scams. However, the links they include will come from URL shortener services, which legitimate agencies aren't likely to use. Always check an agency's website for the proper phone numbers. When you find the correct phone number, call and ask them if they sent a letter or called you. If it was a scam, the agencies would let you know. They should be notified of these calls or letters to alert others about the scams.

5. The Utility Company Imposter Scam

The utility company imposter scam relies on a sense of urgency to get victims to pay. In this situation, scammers will call and state that your utility bill is past due. Most likely, they'll tell you that you must pay a fee immediately to avoid turning off your services. The caller will likely use high-pressure tactics to throw its victims off guard. It seems to work, too, as imposter scams are one of the most costly scams. The best defense against this scam is to state that you’ll call your utility company directly. Legitimate businesses will be more than okay with you taking this action. Most customer service departments at utility companies won't implement procedures such as aggressive calls. Customers know their services will be disconnected due to lack of payment, so utility companies don't need to be aggressive. Many states have regulations against companies using these tactics. In most cases, utility companies will work with customers who are having difficulty paying. They'll send letters working out alternative payment methods. In some cases, they may be required by state laws to do this. With any phone calls, ask for the name of the caller. Then, call the company and ask if this person was authorized to call.6. Phishing Scams And Social Engineering

Legitimate companies will never ask for passwords and other sensitive, personal information over the phone. Phishing and other social engineering ploys try to get victims to reveal business or personal details, such as credit card numbers. They do this by pretending to be a representative from a legitimate company. Phishing attacks are email scams. The scammer uses legitimate logos and company links to get their victims to click on the links. The first clue of a phishing attack is the email address you receive is often not from the genuine company. Scammers who use phishing gather information about you, including which accounts you have. Sometimes, they can purchase this account information from other scammers. Most phishing attacks will seem out of place. For instance, you may have already paid a bill and receive an email shortly thereafter that states your bill is due. Due to this, it’s important to scrutinize every bill that you receive. Social engineering attacks are often more subtle than phishing. The scammer will try to obtain information via pretext, which they'll later use to seem legitimate when they call your bank. For instance, many institutions ask you to reveal your mother’s maiden name. When the scammers know this information, they’ll call your bank to gain access.